Compass Investors

Behind the Scenes

Using thousands of mathematical calculations, our

HORIZONTM

computer model follows

a 5-step analysis

process to identify the best-positioned funds.

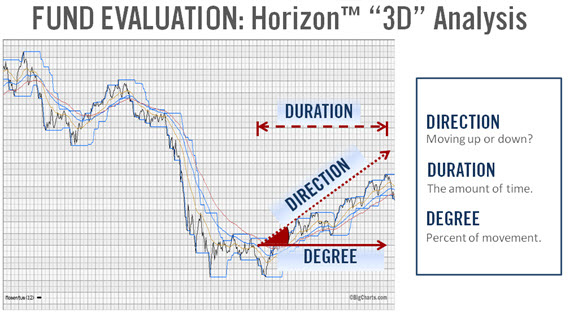

Each Action Report period, the HORIZONTM computer model conducts the following analysis.

*The number and length of time slices, the weighting algorithms and the portfolio allocation percentages are the result of five years of extensive study by the Compass Institute. Over 500,000 possible permutations were tested to develop the correct combination of factors that would provide the optimal result when applied to any well-balanced collection of fund choices.

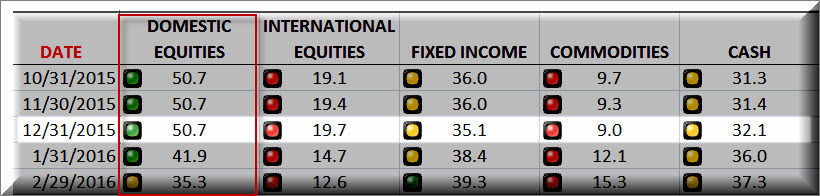

Every investment choice can be assigned to one of five possible asset classes: Domestic Equities, International Equities, Fixed Income, Commodities or Cash.

At the start of each Action Report period we apply a relative strength computation to rank each asset class from highest to lowest based on the price momentum of the individual investment choices in the asset class. The asset class with the highest score is considered "favored." For a detailed discussion of relative strength, click here.

Here's how you can think of this process in layman's terms. Consider the Olympics. Teams of athletes compete against each other in events and are awarded points for their team based on their results. The team with the most points wins the gold medal for that event. For our purposes, our "teams" are the six asset classes, our "athletes" are the investment choices and our "event" is price performance. And, the asset class with the most price performance "wins" is awarded the "favored" asset class designation, i.e., the gold medal.

In the example below, on December 31, 2015, the Domestic Equities asset class had the highest number of "wins" (50.7) and therefore was designated the "favored" asset class.