Compass Investors

HORIZONTM

A simple, safe and effective approach

for managing your investments.

“Two

retirees enter retirement with the same amount saved, earn

the same average annual investment return on their savings and spend

the same amount each year. One dies a multi-millionaire while the

other lives in poverty." Question: How is this possible?

“Two

retirees enter retirement with the same amount saved, earn

the same average annual investment return on their savings and spend

the same amount each year. One dies a multi-millionaire while the

other lives in poverty." Question: How is this possible?

The answer to this perplexing mystery is that the sequence in which each retiree's investment return went up and down was different.

Conventional wisdom says that if you contribute enough and earn a safe double-digit investment return on your money then you are virtually assured of financial freedom in retirement. But, what conventional wisdom fails to tell you is that the order (i.e., sequence) in which the investment returns happen matters and that the timing of a bad year can make or break your retirement.

Let's look at this reality by way of example.

Consider a retiree who was earning $100,000 when he retired. He followed the expert's advice and has saved the recommended 8-10 times his final salary (e.g., $1,000,000). He wishes to spend the same approximate salary he had before retirement each year of retirement, increasing 3% a year for inflation along the way, and expects to earn a double-digit average investment return on his savings.

Question: How long will his money last?

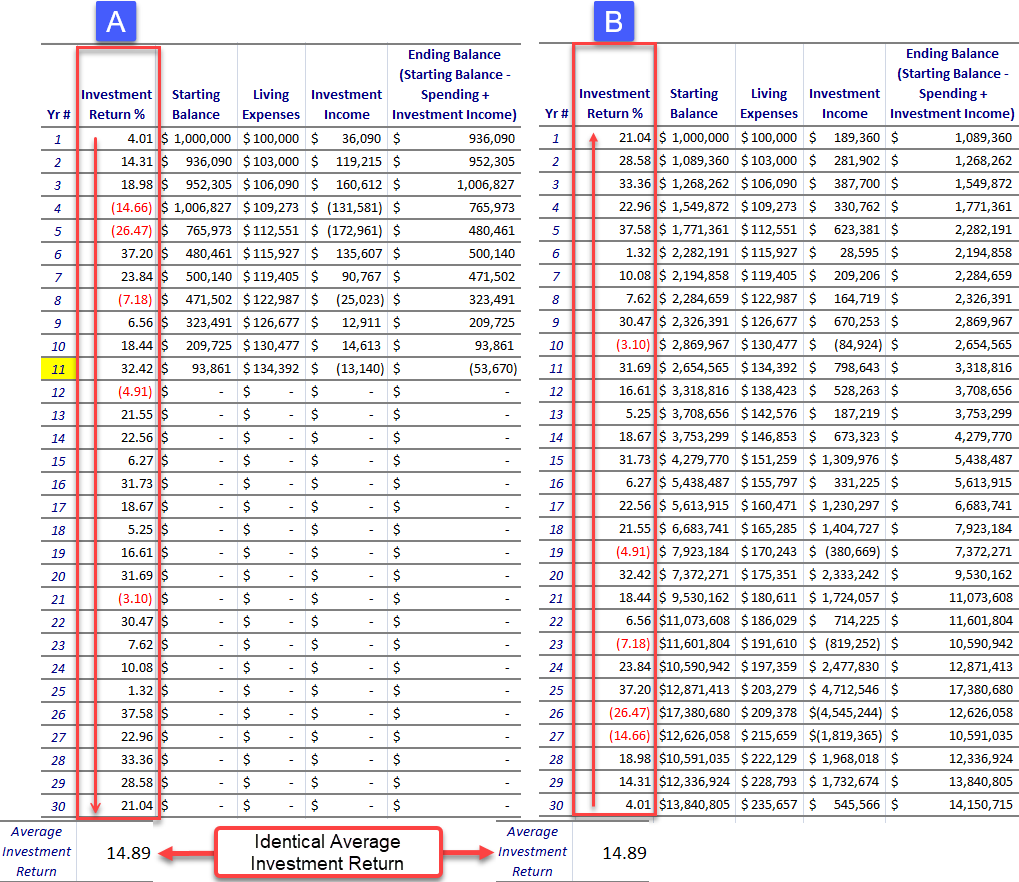

To demonstrate the wide variability of possible answers to that question based on the sequence in which an identical average annual return is obtained, we'll look at a 30-year time period (1970 to 2000) and use the actual returns of the S&P500 during those 30-years as our assumed annual investment return. Note that the average investment return of the S&P500 between 1970 and 2000 was an impressive 14.9%.

The table below shows the starting and ending balances for each year. The left half of the table assumes the annual investment returns for the S&P500 in the actual order in which they occurred (column A). Notice that in the eleventh year the retiree runs out of money (i.e., the Ending Balance is less than $0).

The right half of the table assumes that the S&P500 investment returns during those 30-years happened in reverse order (column B). In other words, year 1's investment return came in year 30, year 2's in year 29, and so on. Notice that while the average annual investment return for the thirty years is identical in both cases, when we reversed the order of the investment returns, not only does the retiree not run out of money in their eleventh year, but he becomes a multi-millionaire 14 times over.

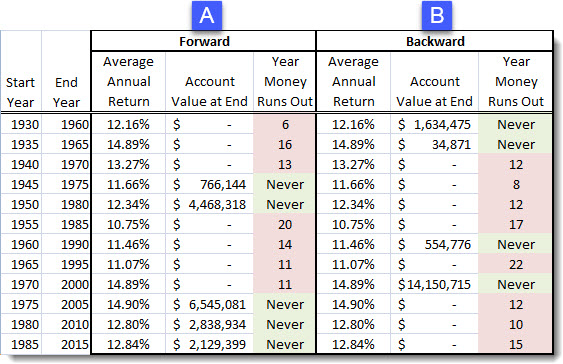

The table below is a summary of the same scenario shown above for twelve different thirty-year time periods going back to 1930, including the years shown above (1970-2000). The left half (A) represents what would have happened given the actual S&P500 returns during those years and the right side (B) the results if the investment returns were reversed. Remember that the Average Annual Return for each time period is identical but, as you can see, the ending results are drastically different.

If this is starting to feel a little like a game of “Russian roulette,“ then you are beginning to understand the magnitude of the Sequence of Return risk! Obviously you have no control over the order in which your investment return happens, and, as these examples demonstrate, even with the same average investment return, it is equally likely for you to do very well in retirement as it is for you to quickly run out of money.

It is a fact that if all the market ever did was go up, then the Sequence of Return would matter little. However, since investing in the market comes with cyclical ups and downs, and since you don't have any control over the size or timing of the next big market decline, the key to minimizing the impact of the Sequence of Return Risk is to minimize the impact and size of the inevitable downward swings along the way. To have the most success when investing, you may find it surprising that it is actually much more important to minimize losses than it is to maximize gains.

While mitigating this risk is always the smart thing to do, it is especially important to realize that you cannot let down your guard in retirement—even if you expect to earn a decent double-digit average annual investment return.

In conclusion, you can still safely build your retirement plan while mitigating the Sequence of Return Risk by using an adaptive approach like HORIZON™ whose goal is to maximize gains in good times and minimize loss in bad.

— Kevin L. Coppola, President, Compass Investors, LLC